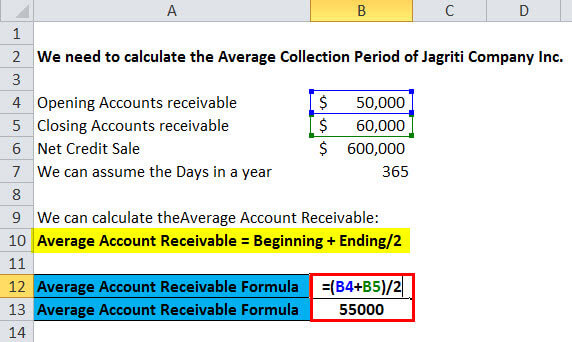

A healthy ratio indicates that the company is effectively managing its customer payments, while a low ratio could be indicative of difficulty in collecting payments or needing to revise their credit terms and policies. The calculation provides an estimate of the number of times a company collects its average accounts receivable balance during a given period. This shows how much money a company has received in credit sales during a specific accounting period and provides an indication of how efficiently the company is collecting Average accounts receivableĪverage accounts receivable is calculated by dividing the total accounts receivable at the beginning of a period (or since inception if this is the first period) by two, then adding that number to the total accounts receivable at the end of a period. This amount reflects the actual sales made on credit during the period and helps to determine how successful a business was in generating sales. It is calculated by subtracting customer returns and refunds from the total credit sales during a measured accounting period. Net Credit Sales, also known as net sales on credit, is an important accounting formula used to measure a business’s performance. The formula is simple: divide net credit sales by average accounts receivable. The accounts receivable turnover ratio is a vital financial indicator of a company’s ability to efficiently manage its credit process and quickly turn receivables into profits. Formula and Calculation of the Receivables Turnover Ratio By keeping close tabs on their AR turnover, businesses can make sure they are getting paid on time and controlling their cash flow.

On the other hand, a low ratio may indicate that the company is having difficulty collecting payments or needs to revise its credit terms and policies. A healthy accounts receivable turnover ratio indicates that the company is doing well in managing its line of credit process and efficiently turning cash into profits. It measures the number of times the company collects its average accounts receivable balance in a given period and provides valuable insight into the company’s collection efforts. The accounts receivables turnover ratio is utilized in financial modeling to determine how efficiently and promptly a company is collecting payments from customers. So let’s dive into understanding accounts receivable turnover so you can maximize your profits! What Is the Accounts Receivables Turnover Ratio?

#Calulator to figure account receivable turnover how to

In this article, we’ll discuss what the accounts receivables turnover ratio is, how to calculate it, how it’s different from asset turnover ratio, why it’s important for financial modeling, and more. Knowing how to measure and monitor your accounts receivable turnover ratio can help you ensure that you’re getting paid on time and improving your cash flow. “Cash is king,” as the saying goes, and accounts receivable turnover plays an essential role in keeping the cash flowing.

0 kommentar(er)

0 kommentar(er)